CMS posts Proposed NBPP 2027. Be afraid; be very afraid. (Part 3)

IMPORTANT: You have until March 13th to SUBMIT A PUBLIC COMMENT to CMS about any of the proposed changes listed below!

It may not make any difference but believe it or not sometimes it does, even under the Trump regime...and in fact in some cases they're actively stating that they're seeking comment as opposed to just ramming the proposed changes through.

The Patient Protection & Affordable Care Act includes a long list of codified instructions about what's required under the law. However, like any major piece of legislation, many of the specific details are left up to the agency responsible for implementing the law.

While the PPACA is itself a lengthy document, it would have to be several times longer yet in order to cover every conceivable detail involved in operating the ACA exchanges, Medicaid expansion and so forth. The major provisions of the ACA fall under the Department of Health & Human Services (HHS), and within that, the Centers for Medicare & Medicaid (CMS).

The HHS Dept. is currently run by RFK Jr., an anti-vaxxer nutjob who just today stated--and this is a verbatim quote:

"I'm not scared of a germ. I used to snort cocaine off of toilet seats."

The CMS, meanwhile, is currently run by modern day snake oil salesman Dr. Mehmet Oz, who doesn't know what Cost Sharing Reduction subsidies are.

With this as prologue:

Every year, CMS issues a long, wonky document called the Notice of Benefit & Payment Parameters (NBPP) for the Affordable Care Act. This is basically a list of proposed changes to some of the specifics of how the ACA is actually implemented for the upcoming year. Some of the changes are minor tweaks; some are major. Some are fairly simple to understand; some get extremely technical & wonky.

The proposed 2027 NBPP was just released by CMS. The full official document is 577 pages long..over 200,000 words total. For comparison, the first volume of the Lord of the Rings trilogy, The Fellowship of the Ring, runs around 187,000 words. Thankfully, even under the Trump Regime, CMS does at least provide a summary of the main provisions, so let's take a look.

The summary includes descriptions (using language to put a positive spin on all of them, of course) of 34 different policy areas. In cases where they get into areas which I'm not knowledgable enough about to comment on, I'll just note that and provide CMS's phrasing as is, or I'll lean on folks more knowledgable about that area than I am (I'll especially be cribbing heavily on Katie Keith, (Director of Health Policy & the Law Initiative at the O'Neill Institute for National & Global Health Law at Georgetown University Law Center) and Matthew Fiedler (Joseph A. Pechman Senior Fellow in Economic Studies at the Brookings Institution), from their even wonkier explainers at Health Affairs (part 1, part 2, part 3).

I should note that while there's a lot of ugly changes below, not every policy change being proposed by the Trump regime is necessarily negative. In some cases they may be genuinely good ideas; in others they're good ideas originally proposed under the Biden Administration which are being implemented now; in still others they may mostly be positive but could have some negative provisions buried within them.

With that in mind, here's Part Three (see Part One and Part Two)...

23. Income Verification When Data Sources Indicate Income Less Than 100 Percent of the FPL

CMS proposes to re-introduce the requirement for consumers to submit documents to verify their income when data sources indicate household income is under 100 percent of the FPL, which was finalized in the 2025 Marketplace Integrity and Affordability final rule (90 FR 27074) and then stayed by the court in City of Columbus et. al. v. Kennedy et. al. This requirement originally included a “sunset” date, and CMS proposes to remove the sunset language.

The ACA's federal premium tax credits are available on a sliding income scale for enrollees with a household income ranging from 100% of the Federal Poverty Level (FPL) up to 400% FPL (the enhanced tax credits which just expired in December didn't have any official upper-income level cut-off and instead tapered off to $0 more gradually, but the lower-bound 100% FPL eligibility cut-off remained in place).

The reason for the lower-bound limit is because the ACA was originally written under the assumption that all Americans earning up to 138% FPL would be enrolled in Medicaid anyway, so there was no point in making the lowest-income bracket of the population eligible for exchange subsidies (as for why the cut-off is 100% instead of 138%, I believe that was the result of a drafting discrepancy between two versions of the ACA legislative text during the legislative process back in 2009-2010.

Instead, of course, in 2012 the Supreme Court ruled that Medicaid expansion had to be voluntary on the part of each state. About half the states expanded it immediately, and since then another dozen or so have gradually done so, mostly via citizen-initiated ballot proposals. However, there are still 10 states which haven't expanded Medicaid to non-disabled adults earning up to 138% FPL, which means there are several million people stuck in the so-called "Medicaid Gap:" They aren't eligible for either Medicaid or ACA subsidies, and they can't possibly afford to pay full price for an exchange plan (many of which cost literally more than their gross income).

Those who live in a non-expansion state but earn between 100 - 138% FPL are in luck thanks to that drafting discrepancy mentioned above, because it means they are eligible for ACA subsidies. However, this also means that there's a subset of the population who earn just a little bit less than 100% FPL.

The Trump Regime is convinced that there's several hundred thousand people living in non-expansion states who are claiming to earn more than they actually do in order to receive ACA tax credits, and therefore wants to require enrollees to provide documentation of their annual income in cases where the HHS Dept. claims to have data proving that they earn less than 100% FPL, making them ineligible.

They haven't provided any evidence of this being a widespread problem, mind you, which is why a federal judge put a hold on this provision when Trump's CMS originally tried doing this last year. From Keith/Fiedler:

...the Columbus court found that these new income verification requirements were arbitrary and capricious because HHS failed to reasonably explain or justify the changes. Without data or other evidence (beyond the agency’s uncited assertions), HHS did not show “sufficient evidence of a nexus between fraudulent enrollment and self-attestation to tax data” such that the new income verification requirements are needed.

Well, Trump's HHS is giving it another shot, this time claiming that they have "stronger evidence" of people who actually earn less than 100% FPL trying to squeeze over the subsidy eligibility line.

We'll see whether a court decides their "stronger evidence" is legit this time or nonsense as so much other "evidence" they've claimed to have on a host of other issues has been over the past year, but this crackdown does go through, HHS expects around 81,000 low-income ACA enrollees to lose subsidy eligibility (and therefore, by definition, healthcare coverage) as a result.

24. Income Verification When Tax Data Is Unavailable

CMS proposes to re-introduce the policy to remove the requirement for Exchanges to accept a household’s income attestation when IRS returns no data for the household, which was finalized in the 2025 Marketplace Integrity and Affordability final rule (90 FR 27074) and then stayed by the court in City of Columbus et. al. v. Kennedy et. This proposal originally included a date to add back in this policy, and CMS proposes to remove this policy permanently.

It's important to keep in mind that deliberately lying about your household income is already a federal offense and that when you enroll in an ACA exchange plan, you're projecting your estimated income for the upcoming year, which means that if your actual annual income for that year turns out to be higher than you claimed (assuming you claimed it was more than 100% FPL), you'd have to pay back some (or potentially all) of the tax credits anyway.

Again, a federal court put a stay on this policy change last summer; if it goes through this time around, HHS expects over 400,000 ACA enrollees to lose some or all of their federal tax credit eligibility, some of whom would therefore also be priced out of coverage at all.

25. Failure to File and Reconcile

CMS proposes to amend the regulations to codify the requirement that, beginning PY 2028, an Exchange must determine a tax filer or their enrollee ineligible for APTC if: (1) HHS notifies the Exchange that the tax filer (or either spouse if the tax filer is a married couple) received APTC for a prior year for which tax data would be utilized for verification of income, and (2) the tax filer did not comply with the requirement to file a federal income tax return and reconcile APTC for that year. For PY 2027, Exchanges would have the option to implement this proposal or continue the current two-year FTR policy. This proposal would provide Exchanges two tracks for adjusting operations to meet the new requirement in section 71303 of the WFTC legislation that Exchanges conduct the one-year FTR process to ensure PTCs are made available only to eligible consumers in PY 2028.

26. Solicit Comment on Eligibility Verification Provisions of the WFTC Legislation, Section 71303

Section 71303(a) and (b) of the WFTC legislation imposes new requirements on Exchanges related to eligibility verification, effective beginning with PY 2028. CMS solicits comments on topics including operational considerations for SBEs, issuers, agents and brokers, navigators and assisters, consumers, and effective communications. CMS seeks input from stakeholders regarding the required timelines to comply with the law and on the anticipated complexity, costs, burden, enrollment impacts, and any state-specific considerations.

Every year when they file their federal taxes, ACA enrollees are supposed to reconcile their actual income for each month of the previous year with what they projected it to be in order to confirm that they received the correct level of tax credits. Currently, if they fail to do so two years in a row they can be denied any further subsidies until they do so. The Trump regime wants to cut this down from two years to one, but the court put a stay on this stating that the ACA specifically put a 2-year grace period in place, so this is something which can't be cut in half via regulatory changes.

Via Keith/Fiedler, the status of this change for 2027 is still vague, but it has been changed permanently via a provision of the Big Ugly Bill starting in 2028 anyway:

Under this provision, consumers will be ineligible for a “coverage month”—meaning they would be ineligible for APTC—for any month where they fail to file and reconcile prior year tax credits for the prior year. And exchanges that fail to implement the one-year policy cannot validly make APTC available to enrollees.

This could potentially mean several hundred thousand more ACA enrollees losing subsidies and healthcare coverage.

27. Audit and Compliance Review Authority Changes

To further protect federal funds, CMS proposes to clarify that HHS has the authority to audit or conduct a compliance review of an issuer offering a QHP through an Exchange to assess its compliance with all applicable requirements pertaining to the APTC, cost-sharing reduction (CSR), and user fee programs, and that compliance reviews may be conducted on an as needed or annual basis rather than only on an ad hoc basis, as determined necessary by HHS.

As Ketih/Fiedler explain, HHS already has some authority to conduct oversight of insurance carriers participating in the ACA exchanges; this would greatly expand that authority:

This proposal would increase HHS’s authority over QHP insurers and potentially enable HHS to assess compliance with a wider range of provisions related to eligibility, enrollment, or plan design. As an example, HHS notes that current requirements do not extend to grace period requirements in subpart C even though noncompliance with these standards—and “other enrollment and payment requirements”—could lead to improper payments. In addition to grace periods, subpart C includes a wide range of QHP certification standards with an ostensible link to APTC, CSR, and user fee programs. (Subpart C includes rules to implement Section 1303’s requirements regarding the segregation of funds for abortion services, but Section 1303(b)(2)(E) of the ACA makes clear that state insurance commissioners, not HHS, are responsible for ensuring that QHP insurers comply with these requirements.)

And that's almost certainly what this is mostly about: Under the ACA, insurance policies which include coverage of abortion services are requred to separate out $1 per enrollee per month into a separate account; the money in that account can only be used to pay for abortions and for no other purpose, and no other funds can be used to pay for it.

The reason for this absurdly convoluted policy is to ensure that not a single dollar of federal funds (i.e., tax credits) is used to pay for an abortion, in order to comply with the Hyde Amendment.

Let's say you enroll in a policy which includes abortion coverage. The unsubsidized premium is $500/month, and you qualify for $400/month in federal tax credits; you pay the remaining $100. A few months into the year, you have an abortion performed. It's therefore hypothetically possible to argue that a portion of that $400/mo tax credit went to pay for the abortion. Therefore, the ACA requires $1/month of the $500/mo premiu to be separated out from the remaining $499.

This is absolutely bonkers, of course, but it's how the ACA has operated since 2014. There are dozens of special bank accounts set up by insurance carriers around the country specifically designed to be "abortion funds." The money in them can't be used for anything else.

As absurd as that may sound already, it gets worse: A few years back I did some basic math and concluded that, since there's likely far more money going into these funds each year than is ever paid out in abortion services, there was likely around $200 million just sitting around, gathering interest which can never actually be touched for all eternity.

That was as of 2021; with the massive growth of ACA enrollment since then, it could be well over $500 million by now.

In any event, HHS is basically saying that they don't trust state insurance commissioners to enforce the "$1/mo abortion rider" provision, so they want to do it themselves. I can't imagine the nations insurance commissioners are going to take that very well, even Republican ones, but we'll see (then again, many Republican states don't legally allow insurance carriers to provide abortion coverage on the individual market anyway).

28. Civil Money Penalty Changes

CMS proposes to reiterate that in determining a CMP amount, HHS would identify the lawful purpose or purposes of the CMP. CMS also proposes to clarify that HHS has the authority to impose CMPs against issuers in SBEs and SBE-FPs for identified violations of any Exchange requirements applicable to issuers offering a QHP in an Exchange when a State notifies HHS that it is not enforcing these requirements or when HHS determines that a State is failing to substantially enforce these requirements. Lastly, CMS proposes net payments owed to issuers and their affiliates under the same tax identification number against certain payments and CMPs owed to the federal government.

29. Administrative Review of QHP Issuer Sanctions

CMS proposes to provide an administrative law judge that would preside over an appeal of a sanction imposed against a QHP issuer, such as a CMP, the option to issue subpoenas and proposes the procedures governing the process for issuing subpoenas. CMS also proposes to revise the application of discovery provisions, so they do not apply to administrative appeals of proposed CMPs for violations identified through audits of the APTC, CSR, or user fee programs. These proposals would improve the accuracy of hearing decisions and increase hearing efficiency.

I have mixed feelings about these two. On the one hand, there has indeed been a growing problem of broker/agent fraud on the ACA markets over the past few years, so cracking down on the issue isn't unreasonable in theory. On the other hand, given the extremely heavy hand and massive overreach of the Trump regime across a host of other parts of the federal government, I'm pretty sure they'd use this authority to bully & extort the health insurance industry the way they're doing with higher education institutions and private corporations on issues of "DEI policy" etc.

30. Quality Improvement Strategy (QIS)

CMS proposes to require QHP issuers to submit QISs addressing any two of the five topic areas listed in section 1311(g)(1) of the ACA, without mandating which specific topics a QHP issuer must address to meet the QIS statutory certification requirement beginning with PY 2027. QHP issuers would no longer be required to submit a QIS that addresses health and health care disparities as a specific topic area within their QIS, which would allow issuers to target quality efforts to the most pressing health outcome needs of their own enrollees and potentially yield more meaningful quality improvements. This change does not impact publicly reported quality ratings.

Basically, the Trump regime will no longer require insurance carriers to report on health disparities. And what are "health disparities?"

Health disparities are largely preventable health differences that adversely affect populations who experience greater challenges to optimal health and are closely linked with intergenerational social, economic, and/or environmental factors—primarily observed among racial and/or ethnic minority populations and/or low socioeconomic status (SES) groups.

Ah, yes, that pretty much speaks for itself.

31. Additional CSR Data in Rate Filings

CMS proposes to require issuers that load rates to account for unreimbursed CSRs for the applicable rating year to submit certain information related to CSR loading in the Unified Rate Review Template and the Actuarial Memorandum for each year in which CSRs are not funded beginning with PY 2027 rate filings.

DANGER WILL ROBINSON.

This is almost certainly the Trump regime's precursor to attempting to eventually ELIMINATE SILVER LOADING, a pricing strategy which has resulted in millions of ACA enrollees saving thousands of dollars per year on higher-quality, more comprehensive healthcare policies every year since 2018.

As Keith/Fiedler explain:

HHS does not propose a ban on CSR loading for 2027. But the proposed rule would impose significant new CSR reporting requirements on insurers with the goal of learning whether “excessive” CSR loading is contributing to inflated premiums for silver plans, distorting bronze and gold pricing, and making premium tax credits overly generous.

...First, insurers would report the aggregate, plan-level amount of actual CSRs paid on behalf of enrollees and how the CSR load amount compares to the actual CSRs paid. This data would be required from the most recent filing year, which would generally be two years prior (i.e., rate filings for 2027 would include CSR-related amounts from 2025), and be calculated using existing methodology. Second, insurers would project anticipated actual CSRs for the upcoming plan year; the CSR load factor and the methodology to determine this load factor; any projected revenue generated from the load factor; and a comparison of the projected actual CSR amount and projected load factor amount.

In other words, it would force insurance carriers into a lot more red tape & busywork, which would cost a fortune. How much?

...This policy would impose a one-time burden of about $418.8 million for the 366 insurers that offer marketplace coverage, or about $1.14 million per insurer. This is in addition to annual costs of more than $210 million, or more than $574,000 per insurer per year. HHS acknowledges that costs could be even higher for insurers that have to build a new system to calculate this CSR-related information. And that’s not all: it will cost the federal government more than $2.4 million per year to review and evaluate the CSR-related information submitted by insurers.

All told, that's ~$630 million next year and another ~$210 million each year after that just to file the paperwork for what insurance carriers have already been doing for 8 years now.

The insurance carriers obviously don't want to eat those costs, so of course they'll bump up their premiums to cover it. If you assume an average of, say, ~19 million effectuated exchange enrollees per year, that's an extra $33 per enrollee in 2027 and an extra $11 per enrollee each year after that.

Ironically, since most ACA enrollees still receive some federal subsidies, that means the tax credits will increase by nearly the same amount to cover the extra $33/$11 per year...meaning ultimately it'll be the taxpayers footing the bill for this additional red tape.

Of course, the ultimate goal of all of this is pretty clearly to reinstate CSR reimbursement payment (which would kill Silver Loading) anyway, which would end this paper chase expense...while also jacking up net premiums even more for millions of ACA enrollees.

32. Expansion of Hardship Exemption Eligibility

CMS proposes to allow individuals who are ineligible for APTC or CSRs due to projected household income below 100 percent or above 250 percent of the FPL to qualify for a hardship exemption. HHS published guidance on September 4, 2025, that expanded eligibility for a hardship exemption to individuals ineligible for APTC or CSRs due to projected household income for consumers in FFE States, SBE-FP States, and State Exchange States that delegate their exemption processing to HHS. The proposed change would expand hardship exemption eligibility to individuals in all states aged 30 and older who receive this hardship exemption to enroll in catastrophic coverage, if otherwise eligible.

This is something which the Trump regime already put into place temporarily last fall; I wrote about it at the time:

I'll let my colleague Louise Norris explain:

Catastrophic plans are only available to certain applicants, have deductibles equal to the maximum annual out-of-pocket limit, and enrollees must pay at least part of the cost of up to three primary care visits before the deductible is met...In addition, an enrollee in a catastrophic plan is not eligible to have premium subsidies paid on their behalf.

And for the purposes of the ACA's risk adjustment program, catastrophic plans are in a separate risk pool from the metal-level plans.

...Catastrophic plans cover all of the essential benefits defined by the ACA, but with very high deductibles, equal to the annual limit on out-of-pocket costs under the ACA...$10,600 in 2026 (for an individual).

Until now there've been very few Catastrophic Plan enrollees...just 54,000 or so this year out of over 24 million nationally, for several reasons:

- You usually have to either be under 30 years old;

- If you're over 30, you have to qualify for a limited range of hardship exemptions

- Applying & qualifying for a hardship exemption requires jumping through a number of administrative hoops

- Catastrophic plans don't show up as an option on the ACA exchange sites if the person applying for coverage is over 30

- You can't apply premium tax credits to them, vastly limiting the number of enrollees who'd have any reason to consider them

- The ACA exchanges don't go out of their way to call attention to them (with good reason)

- They aren't always the lowest-cost option even for those who don't qualify for subsidies

- They aren't even available in some areas

As I explained last fall, expanding Catastrophic eligibility isn't necessarily a terrible idea in & of itself, but it's one more way of pushing people towards the less-comprehensive plans with higher out-of-pocket expenses.

As I noted in a different post last fall, for many prospective enrollees a Catastrophic plan wouldn't even cost less than a Bronze plan:

Unfortunately, in this case, the least-expensive plan (a Bronze HMO which more than doubles the deductible from $9,000 to $21,200) would still cost $2,386/month...or over 1/3 of their income in premiums alone.

How about the Trump Regime's new opening of the floodgates on Catastrophic plan eligibility?

...They'll both be 64 next year, and assuming the Age Band multiplier for Catastrophic plans is the same as it is for other individual market plans in Georgia, you'd have to multiply those prices by 2.68, which would put the cost of a Catastrophic plan for this couple at $2,286 or $2,565/month...basically the same as a Bronze plan anyway.

I also noted last week that Trumps Council of Economic Advisors appear to have their heads up their asses, as they somehow thought that Catastrophic enrollment would explode from 54,000 in 2025 to 3 MILLION in 2026 based purely on this policy change alone (more than 55x as many enrollees). In fact, the early data available from the 2026 Open Enrollment Period suggests that Catastrophic enrollment has doubled or so at most to ~120,000 or so, or perhaps 4% of what they predicted would happen.

33. Further Align Affordability and Coverage Incentives between Catastrophic and Metal Level Health Plans

CMS proposes standards under which catastrophic plans may have terms of multiple consecutive years of up to 10 years and seeks comment on whether to issue similar standards for metal-level plans. Related to that proposal, CMS proposes to allow issuers to make plan-level adjustments to the index rate for such catastrophic plans, and to allow issuers of such plans to apply the applicable cost-sharing for each plan year in the contract, prorated monthly.

Also, multi-year catastrophic plans would be permitted to utilize value-based insurance designs to cover preventive services over and above those that currently must be covered under certain recommendations and guidelines, before an enrollee satisfies their deductible or hits their out-of-pocked maximum. Additionally, to address an issue that has arisen in the implementation of section 1302(c) through (e) of the ACA, CMS proposes to change the permissible cost-sharing parameters for bronze plans and to update cost-sharing requirements for catastrophic plans, beginning in PY 2027.

DANGER, WILL ROBINSON.

HHS would clear the way for insurers to offer bronze and catastrophic plans with MOOPs that exceed statutory limits. As proposed, some bronze plans could have a MOOP that exceeds the statutory limit, and catastrophic plans would cover no benefits until a consumer reached 130 percent of the MOOP. These higher MOOPs would become an option beginning in 2027 and expose consumers that enrolled in these plans to extremely high out-of-pocket costs.

...Insurers that offer at least one bronze plan that satisfies the ACA’s actuarial and cost-sharing requirements (a MOOP-compliant plan) could additionally offer a bronze plan that exceeds the MOOP if doing so is needed to achieve the actuarial value of a standard bronze plan (a MOOP-noncompliant plan).

...HHS would require catastrophic plans to have an even higher MOOP. Beginning in 2027, catastrophic plans could not cover care (other than preventive services or three primary care visits) until after out-of-pocket expenses reached $15,600 for an individual and $27,600 for a family, rounded down to the lowest $50 increment.

Let me repeat that: CATASTROPHIC PLANS WOULD COVER NOTHING OTHER THAN 3 PRIMARY CARE VISITS & PREVENTATIVE SERVICES UNTIL YOUR OUT OF POCKET EXPENSES HIT $15,600 FOR ONE PERSON OR $27,600 FOR A FAMILY.

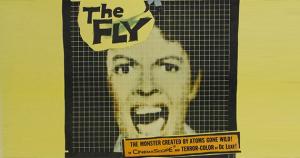

This is essentially The Onion's classic "Infinite Deductible Plan" from 2015 in real life:

ROCHESTER, NY—During a meeting with new hires Wednesday to discuss employee benefits, Radian Analytics human resources manager Ellen Schultz is said to have strongly pushed the company’s infinite-deductible health care option.

According to sources in attendance, Schultz described the low-premium, infinite-deductible plan as the simplest and most convenient choice available to employees, and said it works the same whether plan members need to visit their primary care physician, fill a prescription, or be admitted to a hospital, allowing them in each case to pay 100 percent of the incurred medical expenses.

In addition, Trump's HHS wants to let carriers offer multi-year catastrophic plans for up to ten years...which I guess would mean you'd have the option of having to pay $156,000 before your insurance covers anything, but hey, after that they'd cover everything (or something?). Alternately, they want to let insurers go the other way and divide your deductible up into monthly chunks of $1,300 apiece...I think.

According to Keith/Fiedler, it gets even more insane:

...HHS suggests that insurers could vary the MOOP by disease. Why would an insurer do that? Perhaps to impose a higher annual limit in early years followed by a lower annual limit in later years. As HHS puts it, a lower annual limit in later years would “entice participants to remain in the plan for its duration.” So if an enrollee in a five-year catastrophic plan needed multi-year cancer treatment, the insurer could seemingly impose a higher MOOP early on—putting the enrollee on the hook for even higher costs—so long as the insurer maintained an average MOOP across all plan participants and the five-year period.

This is yet another step in essentially destroying the entire point of the Patient Protection & Affordable Care Act: That you never know what sort of healthcare expenses you're going to need from day to day much less year to year, as Keith notes:

Of particular note, HHS asks whether insurers should be able to change any terms of coverage during a multi-year term and expressly acknowledges the “potential interactions” between this proposal and the ACA’s market reforms and consumer protections—including guaranteed issue, age rating, and uniform modifications to coverage.

And finally...

34. Comment Solicitation on Potential Changes to the MLR Standard

CMS seeks comment on the impact of the Federal MLR standard on individual market costs and premiums, whether to amend regulations to enable HHS to adjust the MLR standard in the individual market (including in states that do not request an MLR adjustment), and how to reduce burden for states interested in requesting an adjustment to the MLR standard for their individual market.

Under the Affordable Care Act, insurance carriers have to spend at least 80% of premium revenue on actual medical claims. If they spend less than that (on a 3-year rotating basis), the balance has to be given back to the policyholders in the form of a rebate check. This is called the Medical Loss Ratio (MLR) rule, and it has refunded literally billions of dollars to enrollees, including over $1.6 billion in 2024 alone (the last year for which data is available).

Technically Trump's HHS isn't actually changing anything here, they're just sending up a trial balloon; they apparently want to screw around with the formula & rules for calculating MLR thresholds and rebates in the future, even for states which don't want any adjustments (which, to date, includes all of them), and want people to chime in.

I have no idea what they have in mind here but my guess is I won't like whatever it is.

IMPORTANT: You have until March 13th to SUBMIT A PUBLIC COMMENT to CMS about any of the proposed changes listed above!

It may not make any difference but believe it or not sometimes it does, even under the Trump regime...and in fact in some cases they're actively stating that they're seeking comment as opposed to just ramming the proposed changes through.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.